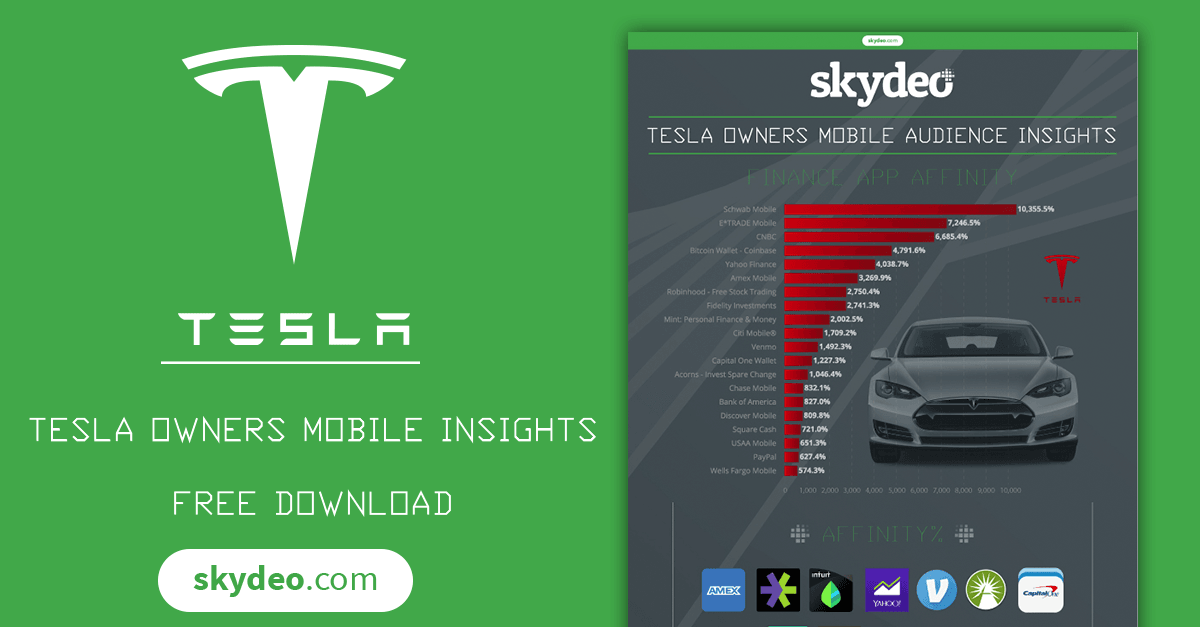

Tesla Owners Mobile Personas - Skydeo Insights

Tesla Owners Mobile Personas - Skydeo Insights

Tesla Owners Analysis by Skydeo Insights. In a recent panel study of...

Tesla Owners Mobile Personas - Skydeo Insights

Tesla Owners Mobile Personas - Skydeo Insights

Who is using Bitcoin? Skydeo Insights by Apps, Age, Gender & Net Worth

Who is using Bitcoin? Skydeo Insights by Apps, Age, Gender & Net Worth

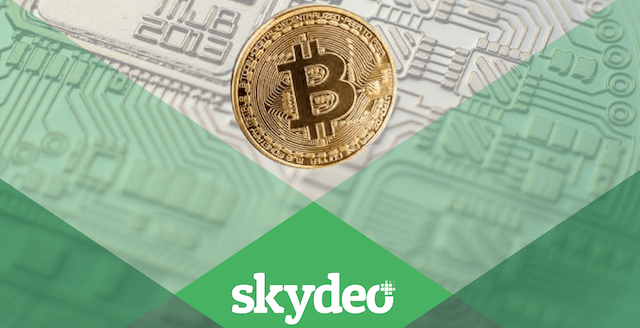

Dropbox vs. Spotify IPO: App Intelligence - Alternative Data

Dropbox vs. Spotify IPO: App Intelligence - Alternative Data

Skydeo joins DCU Fintech Innovation Center in Boston

Skydeo joins DCU Fintech Innovation Center in Boston