Inc. Magazine Names Skydeo The Fastest Growing Tech Company in Southwest, Texas & Austin

Inc. Magazine Names Skydeo The Fastest Growing Tech Company in Southwest, Texas & Austin

Magazine Ranks Skydeo as Fastest Growing Tech Company in Southwest United States...

Inc. Magazine Names Skydeo The Fastest Growing Tech Company in Southwest, Texas & Austin

Inc. Magazine Names Skydeo The Fastest Growing Tech Company in Southwest, Texas & Austin

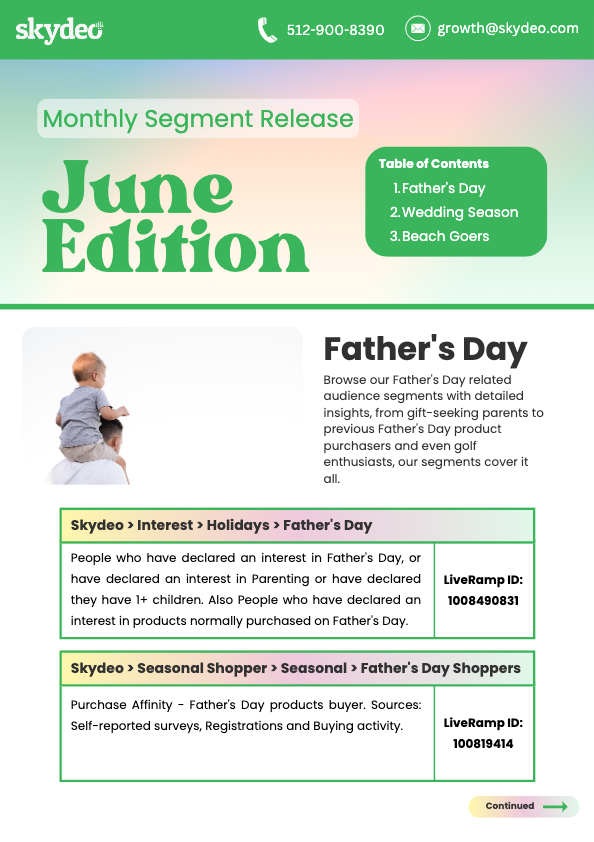

Monthly Segment Release: June Edition

Monthly Segment Release: June Edition

Lookalike Modeling: What You Need to Know

Lookalike Modeling: What You Need to Know

25 Most Popular Audience Segments: May Edition

25 Most Popular Audience Segments: May Edition

F1 Miami Grand Prix 2023: everything you need to know

F1 Miami Grand Prix 2023: everything you need to know

Sports Market Segmentation: The 2023 NHL Playoffs

Sports Market Segmentation: The 2023 NHL Playoffs

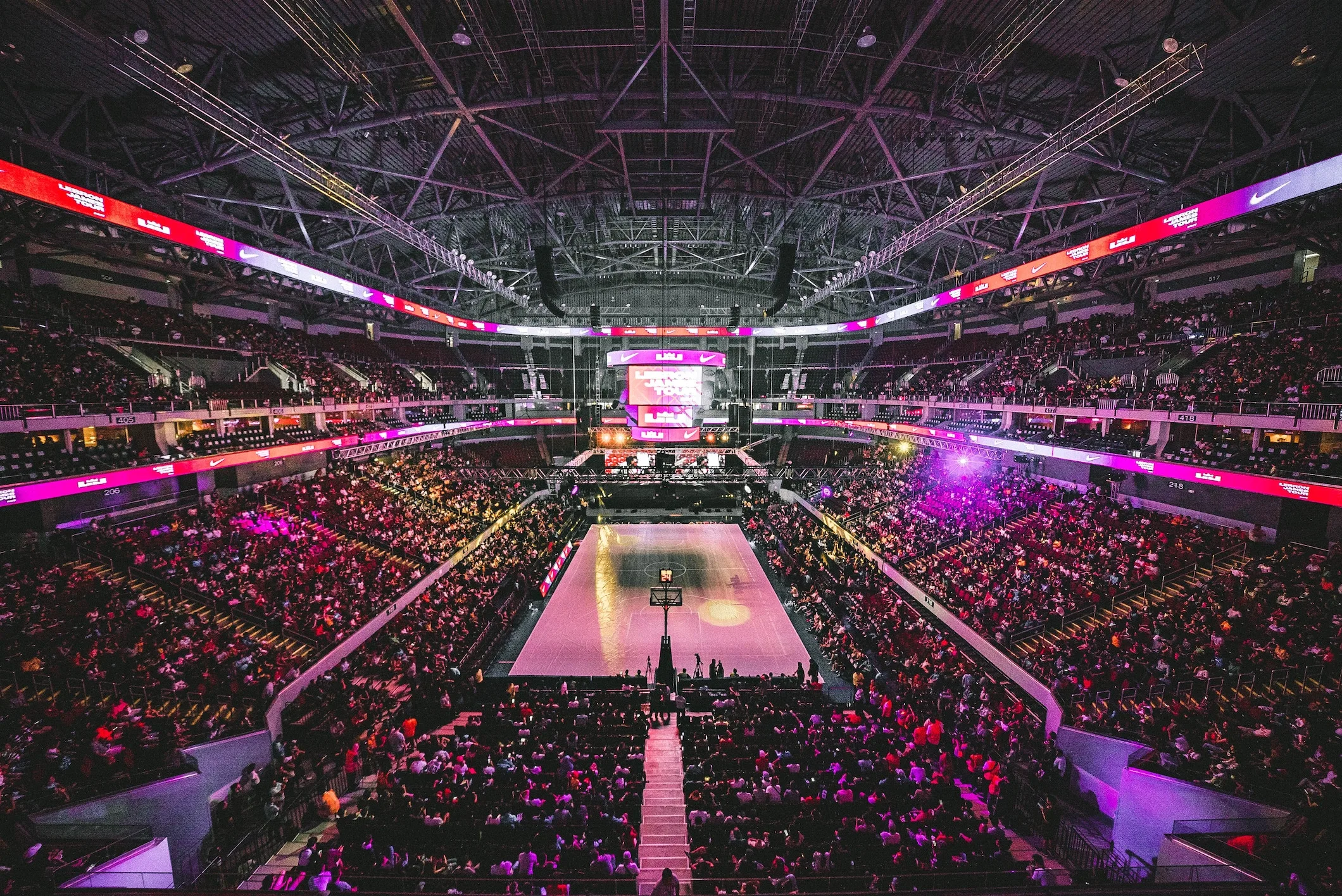

Maximize Your NBA Playoffs Advertising ROI

Maximize Your NBA Playoffs Advertising ROI

Advertising During The Masters: How to Reach Golf Enthusiasts

Advertising During The Masters: How to Reach Golf Enthusiasts