No Cookies? No Problem: How to Survive the Cookiepocalypse.

No Cookies? No Problem: How to Survive the Cookiepocalypse.

The holiday season was already a madhouse. And now: Boom! The digital...

No Cookies? No Problem: How to Survive the Cookiepocalypse.

No Cookies? No Problem: How to Survive the Cookiepocalypse.

Lookalike Modeling: What You Need to Know

Lookalike Modeling: What You Need to Know

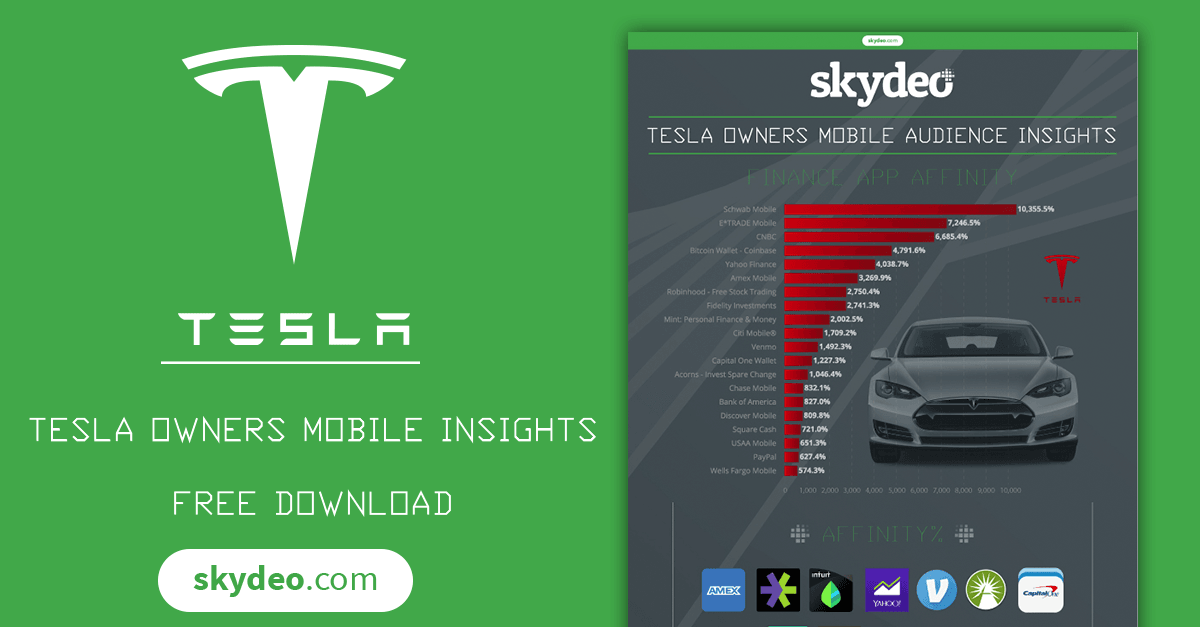

Tesla Owners Mobile Personas - Skydeo Insights

Tesla Owners Mobile Personas - Skydeo Insights

Who is using Bitcoin? Skydeo Insights by Apps, Age, Gender & Net Worth

Who is using Bitcoin? Skydeo Insights by Apps, Age, Gender & Net Worth

Uber Driver vs. Lyft Driver Market Share by Skydeo

Uber Driver vs. Lyft Driver Market Share by Skydeo

How to Target Mobile App Users in Google Adwords

How to Target Mobile App Users in Google Adwords

How Top Publishers Use Mobile AppGraph Data To Drive Ad Targeting

How Top Publishers Use Mobile AppGraph Data To Drive Ad Targeting

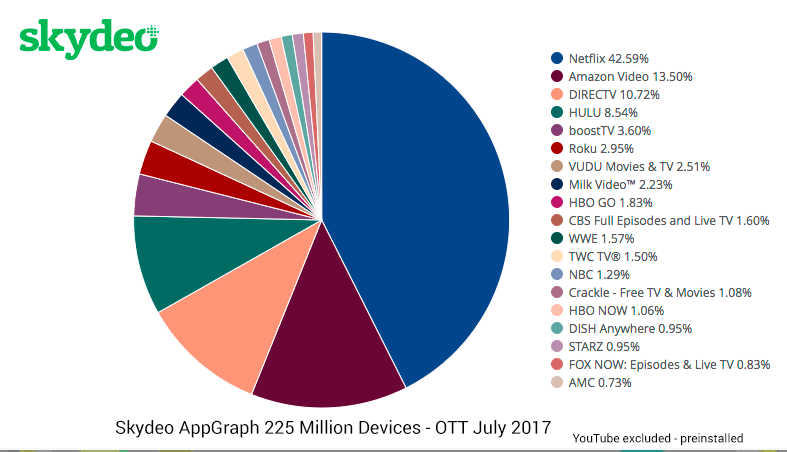

Getting Down with OTT & Video Streaming Apps

Getting Down with OTT & Video Streaming Apps